unemployment insurance tax refund

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. The IRS has sent 87 million unemployment compensation refunds so far.

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

For this round the IRS identified approximately 46 million taxpayers who may be due an adjustment.

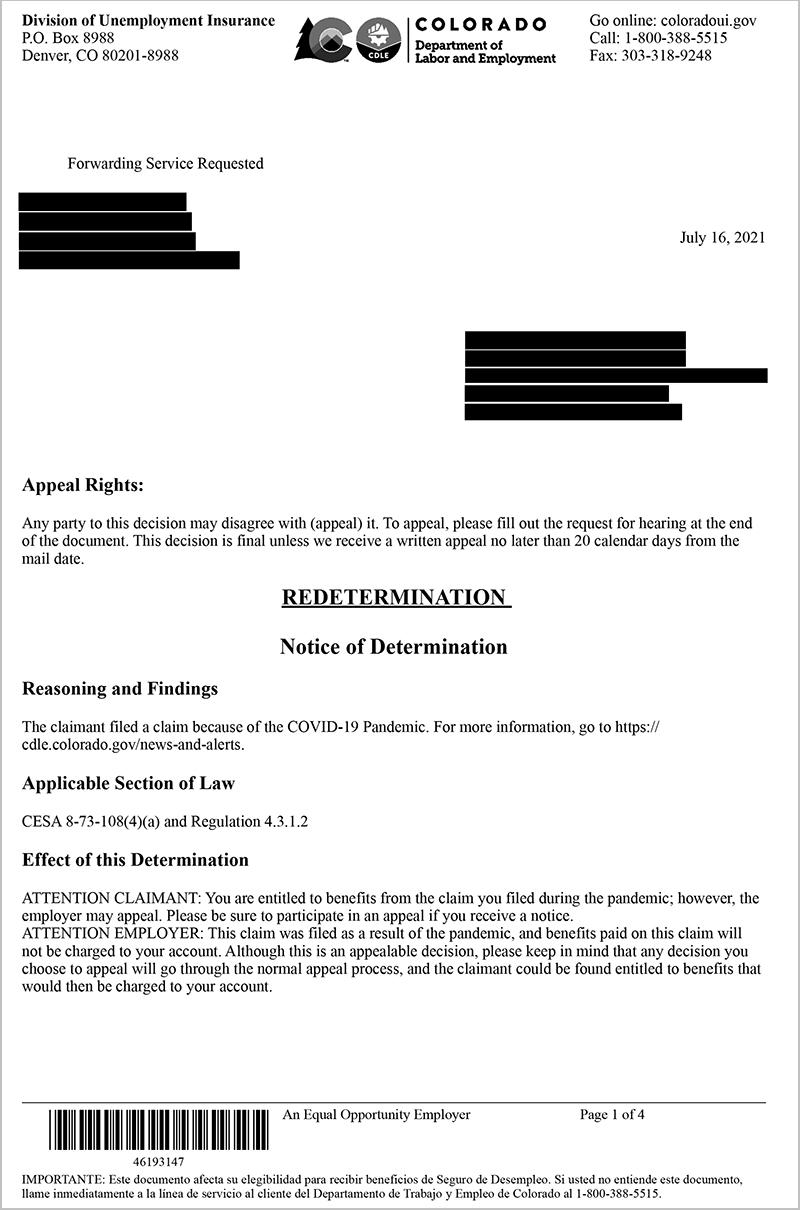

. The UI program pays benefits to workers who have lost their job and meet the programs eligibility. If an adjustment was made to your Form 1099G it will not be available online. UC Management System UCMS UC Tax Overview.

If you are liable for unemployment insurance premiums in Tennessee you will be assigned an eight-digit employer account number eg 0000-000 0. File Wage Reports Pay Your Unemployment Taxes Online Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information. Return completed and signed form to the UI Compliance Bureau by fax.

Nebraska businesses of every size and industry use NEworks to connect with thousands of highly qualified job seekers including a large bank of professionals high-skill individuals and. Form 1099G tax information is available for up to five years through UI Online. For any Unemployment Insurance Tax questions please contact the UI Operations Center at 1-877-664-6984 Monday through Friday 800 am.

UI Compliance Bureau Idaho Department of Labor 317 W Main Street Boise ID 837350760. 208 3346301 Or mail to. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010.

Of that number approximately 4 million taxpayers are expected to receive a. If you see a 0. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

For some there will be no change. The EDD manages the Unemployment Insurance UI program for the State of California. File a Quarterly Wage Report Make a.

This taxable wage base is 62500 in 2022. The law waives federal income taxes on up to. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers. Security of the Arizona Tax and Wage System Tax and Wage System Overview Use the Unemployment Tax and Wage System TWS to.

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com

Unemployment Benefits Tax Issues Uchelp Org

Unemployed In 2020 Get Ready For A Big Tax Refund

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

2020 Unemployment Tax Break H R Block

Taxes 2021 What To Expect For The 2021 Tax Season Tax Foundation

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Tax Refunds Coming To Some Folks Who Got Unemployment Benefits Ktul

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Unemployed Workers Could Get A Nasty Surprise At Tax Time

Pandemic Unemployment Decisions Notices Of Determination Department Of Labor Employment

Are You Owed A Tax Refund For Unemployment Benefits Here S What You Need To Know Silive Com

What You Should Know About Unemployment Tax Refund

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

When Will Irs Send Unemployment Tax Refunds King5 Com

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings